Why would you file a patent application as a startup? Go through the hoops and expenses and actually publish all your secrets?

I often get this question from startup founders. Let’s break it down. I intend this to be a trilogy, so a whopping three posts if I can find the time. Just went to see Star Wars IX; thought it was time to do my own trilogy. Covering the why, what (Episode II), and how to write the application, and tricks to save on cost. That actually makes four, but hey, Star Wars episode order is thoroughly confusing too. Of course, I focus on software patents, which makes things slightly more tricky.

There are many different and opposing reasons to patent or not to patent. Let’s start with the latter.

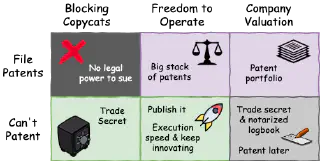

The common perception is you need patents to fight competition trying to copy your secret sauce. Forget it. Patents are not going to save you here. Why not?

Your startup simply does not have the financial and legal horsepower to pick a patent fight and win it.

And let’s face it, in many cases competition can work around your patent. Just a slightly different solution, and beat you to the market.

“Wait, so patents don’t protect me from copycats? How do I stay alive among the hungry predators then?” In practice, startups adopt two complementary approaches: secrecy and innovation speed.

What you can’t see you can’t steal. A trade secret that is not easy to copy. When Dr. John Pemberton invented Coca-Cola in 1886, the formula was kept a close secret, only shared with a small group and not written down. Today, the secret recipe is locked away in a vault. That is on display in the Coca-Cola museum in Atlanta to further enhance the magic. Secrecy served them well.

To protect your secrets you sign a Non-Disclosure Agreement (NDA) with partners and clients. An NDA often has a limited time span, typically no longer than three to five years. Right about the time that your business is scaling up and competition is waking up. Watch out.

Also, a secret is considered a secret only if it is confined to a minority. The jury is not exactly out on this one, but common opinion (by the IP lawyers) says that if you sign NDAs with the majority of the market players, the court will consider your secret as published. NDA invalidated.

Maybe you signed a mutual NDA with a potential competitor and they (happily) tell you all their secrets. What if your own Willy Wonka already came up with the same idea, or would have seen the light later? Now that’s covered by the NDA. Patent opportunity, or worse, business potential gone.

Bottom line: be careful with NDAs if you don’t want to spill the beans.

If you can’t avoid users to see your secret sauce or your sauce is not all that tasty, the only way to avoid copying is to keep innovating. Beat your competition to the market. Then keep innovating to stay ahead. By the time competition copied your work, you are already ahead with a better, bigger, cheaper solution in the market.

This is where investors like to see your roadmap. Checking if you are not a one-trick pony, but have the team and capacity to run at the frontline for a long time. Note that startups often get this wrong. Don’t forget that staying ahead lies in execution. Not in dreaming up the next technology nirvana.

Gartner’s magic quadrant nicely judges on ability to execute versus completeness of vision. Don’t forget to execute in the market. ARM won the embedded processor market despite MIPS having the better technology. ARM simply had better execution, understanding that a large ecosystem of software libraries, peripheral IP, and optimized applications is more important than the underlying tech. Coca-Cola’s success is attributed to their tremendous marketing efforts. The story of the secret formula and mystery surrounding it further fueling the brand.

The major reason to file a patent is to provide your business the freedom to operate. Protect you in case a competitor slams you with a patent that covers your technology. And blocks you from selling your solution. If you own the patent, you are untouchable. Shields are up.

The underdog with the smaller stack pays the licensing toll. You can improve your position by looking one level deeper at the breadth and quality of the patents on the two stacks. Maybe you can increase the weight of your stack by showing your claims are stronger.

Of course you could try to prove that their patent is unjustly granted. Find prior art: a publication of the invention that predates the filing. However, fighting a granted patent is a costly legal battle. Prevention is your best bet; make sure you have a decent patent portfolio.

Tesla’s pledge not to sue

Following IBM’s 2005 example, Microsoft published their Commitment not to Sue. Tesla followed suit in 2014 with their Patent Pledge to “not initiate patent lawsuits against anyone who, in good faith, wants to use its technology”. This applies to every patent that Tesla has now or in the future. For Tesla and Microsoft, their patents bring freedom to operate. With the pledge they chose to extend that freedom to others.

It specifically mentions “the Pledge is not a waiver of any patent claims … and is not a license, covenant not to sue, or authorization to engage in patented activities …”. Tesla could be hit by a claim themselves. Making a pledge or promise avoids liability for damages on sub-licenses. A promise or pledge is not a license, and contrary to a license, a promise doesn’t require a formal agreement between parties. Specifically crafted for the open-source community, no one downstream needs to obtain a license. But no guarantees either.

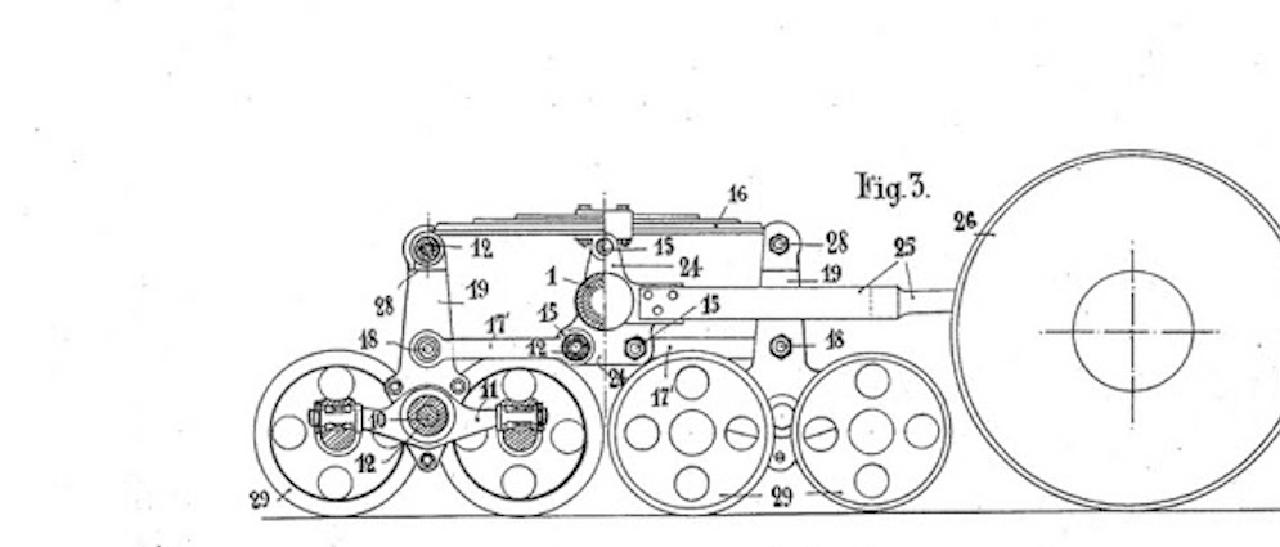

The good (and rather shady) news here is often a surprise for the perfectionist tech founder. Your patent does not have to be perfect. Reality is that in the 19 hours on average a US examiner spends to review your patent application, they simply can’t perform an exhaustive search of every idea ever published. In the entire world. In every language. If you get it granted—even if there are similar ideas predating yours—your patent carries its weight on the stack.

Corporates file patents on the invention of the wheel, sliced bread, and generally stuff that’s already out there. Anything to “defend” themselves from the trolls. Just submit it and pray it gets granted. Luckily, there is a tiny provision in the US Patent Reform Act that states:

“Any person at any time may cite to the Office in writing prior art consisting of patents or printed publications which that person believes to have a bearing on the patentability of any claim of a particular patent.”

Together with the US Patent & Trademark Office (USPTO), several organizations jumped to the occasion. Google Patents includes a prior art search. While Joel Spolsky’s Ask Patents claims to help find and submit prior art, it is merely a (powerful) Q&A on the topic. So where do you submit prior art? You can submit prior art at WIPO. The (self-acclaimed) largest prior art database ip.com requires a voucher to submit.

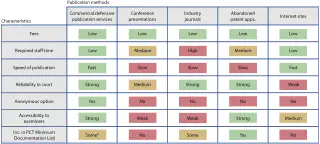

Can’t patent your tech or can’t afford it? Publication is another way to safeguard your freedom to operate. If you show the world your innovation in the form of a defensive publication, others can’t patent it. With your tech out in the open, all the more reason to get to market fast. And keep innovating.

A French study from 2012 looked at what are the best channels for a defensive publication. The study concludes that the examiners predominantly access commercial defensive publication databases like TDCommons, and abandoned patents. Journals and conference proceedings are hardly accessed.

Given the above, why are VCs so adamant on filing patents? For most tech startups, valuation goes up if you have a strong patent portfolio. Many tech VCs won’t even step in if you don’t have patents to protect your IP.

Assume you sell your startup to a big company, get rich, get your investor their return, and conquer the world from the new mothership. They do have the legal power to go out and hit your competition with your patents.

As you operate at scale now, you get noticed. Competition feels the pain of customers jumping ship towards your offering. This is the moment where you need that patent portfolio to fight off the trolls.

One way to avoid the cash out in early startup life is to only file the patents after a big VC round, typically the A-round. You need to ensure you have sufficient proof to claim the priority date of your invention. And keep it secret!

In the old days, the Dutch tax office offered a notarization service where you could file your ideas in secret, yet still get their official time stamp on your logbook. Nowadays, an encrypted document on the InterPlanetary File System (IPFS) would technically do the trick. Or a hash of your document on a public blockchain. However, I doubt patent officers are sufficiently tech-savvy to accept this as formal proof.

The tricky part is also that your claims must be fully covered in the notarized logbooks. You literally should be able to go over the passages in your notebook with a highlighter pen to construct the claims. If not, you don’t get the original priority date. Tough luck.

Patents have real value in an exit or as you become a worthy market player. Until that time, they are a necessary evil.

A common mistake aspiring founders make, is to extend the IP or build the market too early. Startup accelerators and coaches that advocate the Lean Startup may advise you to validate your business in the market first.

Please don’t.

Not while you don’t (yet) own the IP. As a PhD still under contract by the university for instance. Building the business case. Adding value before you strike a deal to license or buy the IP from your university. Congrats, you just shot yourself in the foot. Stop building the business. Secure the IP first. Only then increase the value (and valuation).

The same holds for a spin-out of a larger corporate. Maybe the IP is outside the corporate focus market. Make the deal before you wake them up to the new business you intend to unlock. Large companies typically are happy to patent ideas outside their business scope. Just so their stack is as big as it can get. Make sure that doesn’t prematurely murders your spin-off plans.

Don’t make the mistake as aspiring entrepreneur to add value to the IP before you secured the ownership.

In Episode II of my patent trilogy, we delve into what’s eligible to patent. Especially in the realm of software.

About Martijn Rutten

Fractional CTO & technology entrepreneur with a long history in challenging software projects. CTO at LUMO Labs impact VC. Former CTO of scale-up Insify, changing the insurance space for SMEs. Former CTO of fintech scale-up Othera, deep in the world of securitized digital assets. Coached many tech startups and corporate innovation teams at HighTechXL. Co-founded Vector Fabrics on parallelization of embedded software. PhD in hardware/software co-design at Philips Research & NXP Semiconductors. More about me.

Related Posts