How do you best describe your technology to an investor, and make sure you stand out? The usual feature table with checks and crosses in the pitch deck or investor memorandum does not give much insight. This post gives you a unique tool: my Pragmatic Startup Technology Quadrant.

This is especially geared towards venture capitalists looking at your business. However, I used this most of my career to judge technology on its merits in industry. Be it academic technology transfer, corporate innovation, or a tech startup. I wrote about my technology quadrant earlier in the context of academic technology transfer. Now, I fine-tuned it for startup tech and their investors. In the many occasions I applied this quadrant, it was a true eye opener for the entrepreneurs. And worked like a charm to put their feet right back on the ground.

Investors of course like to see why your startup is gonna make it. Preferably in a nice graph or chart that is easy to pop up at the fund committee meeting. The investor should be able to easily reproduce the graph to an interested (preferably wealthy) acquaintance. On a napkin. In a bar. After a few bottles of expensive wine charged on the company account. So keep it simple yet powerful.

Need to present your competitors to an investor? Draw a quadrant, and put your startup or technology top-right. Why? Success is always top-right, so that’s where you’ll be.

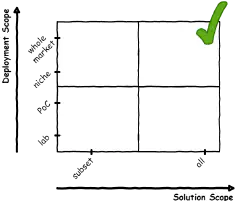

Great. Now let’s think about the axes.

Vertically we see the deployment scope. To what extent has your amazing technology been exposed to the harsh reality of the market?

Technology Readiness Levels

EU-funded research projects adopted the Technology Readiness Levels (TRL), originally developed by NASA in the 1970s to check the maturity of a technology. This says a lot about the level of productization and hence a good measure for the deployment scope (vertical axis) of the quadrant. As this relates predominantly to research projects, the accent is on the early stages of deployment with levels 1 through 8 all in the bottom left quadrant. Nice for subsidy in the early stages, but not suited to get a VC across the line.

So what’s in the quadrants?

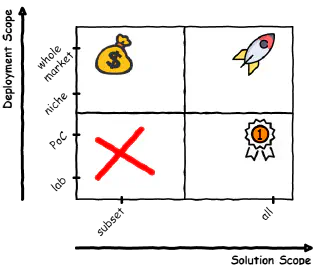

Clearly the startup nirvana is here, solving the full problem and proven in the whole market. This is the land of the Big Hairy Audacious Goals (see my post on why you need a BHAG). A level-5 fully-autonomous self-driving car. In Delhi. At rush hour. When it is raining. Or to remain in Elon Musk territory: living on Mars. A bit closer to home for me is ASML’s Extreme UV (EUV) wafer stepper. The technology and physics challenges ASML had to overcome to create a UV light source to illuminate silicon wafers and keep on track with Moore’s law were equally crazy. One invention was rotating electrodes to keep them from melting and depositing unwanted layers of tin as they generate the plasma. Wild stuff.

Let’s face it, you don’t reach this quadrant so easily. So let’s look at the other quadrants first.

So you have some basic technology that any first-year student could have made. And it works on a laptop in your lab. That’s great. A bit more ambition please. Most of the public blockchain stories end up here. A simple smart contract to notarize a document. But no thought on making it work for the masses that don’t know how to create a private key and not lose it. This quadrant is a good place to start, but not without the ambition and roadmap to get out of this quadrant as soon as possible.

Here it gets interesting. Sexy, sophisticated technology, and already working in the lab, maybe even a proof of concept. This is where 95% of the academic paper awards are handed out. The awards triggering the new PhDs to found their own business. Cool and complex tech tested in an academic environment, an abstraction of the real world. Also a fantastic place for press releases to announce your proof of concept results. Virtually each and every proof of concept in blockchain (or its preferred DLT euphemism) is in this quadrant and nowhere else. The Singapore stock exchange blockchain project UBIN. Done by Accenture and a number of other consultancies that know how to write invoices. State of the art stuff with zero-knowledge-proofs used by a unique global-netting algorithm (look it up if you are into blockchain tourism). Laptop to laptop. Started 2016, the project never got out of the bottom-right quadrant, but surely got extensive PR coverage.

What else is in this space? A lot of the deep learning hype is here. Typically any hyped technology that is not yet time-tested and technologies that are still looking for a real market problem.

The obvious thinking is to start here with your unique technology and full system, and then incrementally move up the ladder into the real world. Straight up to the nirvana quadrant. Technology-push startups operate on this belief, as do many academics. “Almost there, just gotta go from TRL 5 to 9. Just gimme a bit more subsidy please.”

Forget it. As the investor would say: “any further investment at this point is throwing good money after bad money”.

Don’t let the awards and PR mislead you into thinking this is market validation of your technology. You will hit every barrier possible so hard that you will run out of time and money long before the first client takes it to production. Too many hurdles to overcome.

This is the sweet spot. Technology that’s simple enough to make it work out there. This is were you make money. No press, no best paper awards because your tech is not sexy. Well until you hit the unicorn status and you are sexy because you got rich. Companies that make it here started in the bottom left. Where they were laughed at by the VCs. And then moved up. Some VCs publish a Wall of Shame, with early startups they jolted out of the door and became a huge success once they scaled to the real world. Google, Skype, Dropbox. Dropbox is a nice example. File sharing was a total red ocean with many solutions out there. The only thing DropBox did was make it work. On any device. Out of the box. File sharing technology is simple, anyone can do it, but make it work on any system? That’s proper rocket science.

This is where the European automotive industry shines with level 2 driver assist systems. Traffic sign detection, lane centering assist, adaptive cruise control. Small, incremental steps towards a fully autonomous car. But fully certified and tested by millions of users every day. SpaceX is here too. Wanna go to Mars? Let’s first make a reusable rocket that can land back onto the launch platform.

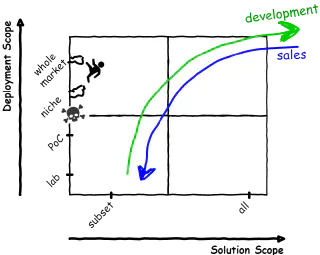

The only way to get to the top right nirvana is from the top left. Baby steps, fixing shit all the way.

Making it work in the real world, with all its quirks and passing the roadblocks one by one. Even dealing with misbehaving users (the new hype of making video’s of having sex on the highway while your Tesla does the driving), and cost-down to stay competitive. The problem is you need to make money along the way to buy the time you need to get it right. In other words: “how to not go bankrupt before you reach your final destination?”. Startups notoriously hit the following two major roadblocks while moving up from the bottom left to the top left.

Many startups hit the infamous valley of death going from a proof of concept to a money-making product in a niche market. The initial seed money gets you to a proof of concept. The A-round in theory should get you to the market with sufficient revenue to hit break-even, and from there get into a big scale-up B-round to get (your investor) rich. In practice, the A-round money typically can be stretched just long enough to get the product completed. But that doesn’t mean it gets your lead customer excited. The diligent engineering required to make the first customers happy enough to pay the bills is always underestimated. Typically this results in a bridge round where the founders’ shares dilute considerably, and more time and focus is spent on staying afloat than on scaling the business.

Startups that survive the valley of death often have a lead customer early on, and manage to sign contracts with up-front cash for engineering the product. SpaceX is getting NASA to pay for their rocket development as SpaceX supplies the international space station. The next step to go to the moon is also paid by the US ambition to show off once more. One step closer to Mars and fully paid by NASA. Not exactly a startup, but how did ASML pay the development of their EUV technology? ASML played on the “fear of missing out” among their three major customers and raised a billion to get started. DropBox made a proper Lean Startup style video after beta testing that went viral to cross over from beta testing to paying users.

The next roadblock on the vertical axis is Geoffrey Moore’s famous “Chasm” that you need to jump over to go from a niche market to the whole market. Typically you started with a generic technology that is a good 80% match to any market. Then with a lot of engineering and relationship building, you made it into a 100% product-market fit for one niche market. With actual buyers. Now is the challenge to make it fit 100% for everybody out there. All the scalability, diversity, integrations, productization, and regulatory stuff above. While your current customer base does not deliver enough revenue to significantly scale your resources. So the objective is to move further up along the vertical axis. At the same time moving to the right to maintain your competitive edge, as now there will be more parties waking up to your proposition.

So we need to start with simple technology, incrementally make it work in the market, and then inch our way towards the full solution scope. “Wait, that’s not a sexy story I can tell my customer or VC without blockchain or artificial intelligence!”

Have a look at the blue and green arrows in the above quadrant. That’s right, notice that startup sales (sadly all too often) follows the opposite way of development through the quadrant.

That’s my quick and pragmatic napkin-based tool to judge if a new technology will make it in the market. Plot the proposed technology along the development axis, as well as along the sales axis. Don’t forget that:

whenever a startup gives you their pitch or technology demo - what you see, is all there is.

Where is your project on this canvas?

About Martijn Rutten

Fractional CTO & technology entrepreneur with a long history in challenging software projects. CTO at LUMO Labs impact VC. Former CTO of scale-up Insify, changing the insurance space for SMEs. Former CTO of fintech scale-up Othera, deep in the world of securitized digital assets. Coached many tech startups and corporate innovation teams at HighTechXL. Co-founded Vector Fabrics on parallelization of embedded software. PhD in hardware/software co-design at Philips Research & NXP Semiconductors. More about me.

Related Posts